42 consider a bond paying a coupon rate of 10 per year semiannually when the market

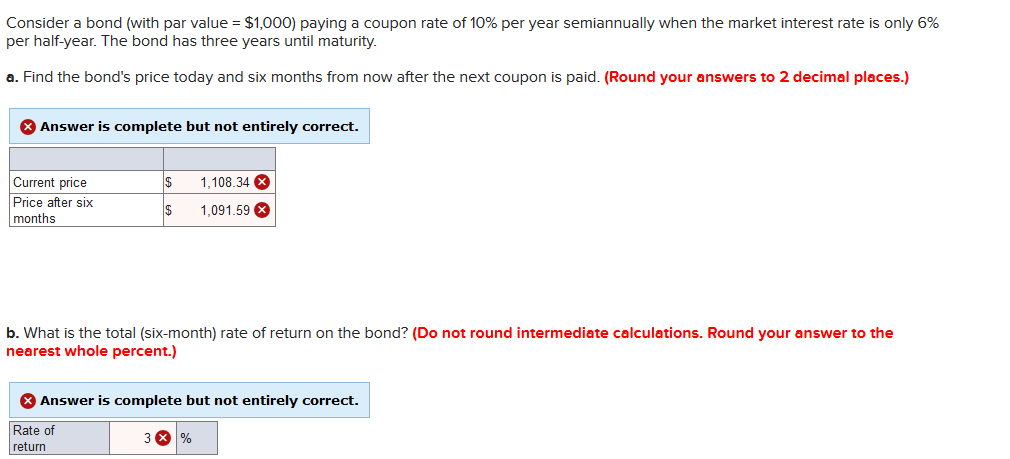

Practice problems - Consider a bond paying a coupon rate ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Consider a bond paying a coupon rate of 10 per year ... The 3 year bond is paying a 10% coupon rate (semi-annually) that has a market rate interest rate of 4% per half year. a. Calculate the bond price. PMT = (10%/2 x 1,000) = 50 FV = 1,000 n = 3 years x 2 = 6 r = 4% PV = 1,052.42 Price of the bond six months from now can be calculated by assuming that market interest rate remains 4% per half year.

Consider a bond paying a coupon rate of 10% per year ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4%. The bond has 3 years until maturity. a. Find the bond price today and six months from now after the next coupon is paid, assuming the market rate will be constant during the following 6 months. b.

Consider a bond paying a coupon rate of 10 per year semiannually when the market

Solved Consider a bond paying a coupon rate of 10% per ... See the answer Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year. The bond has three years until maturity. Find the bond's six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Expert Answer (Solved) - Bond Price, Rate of Return, Yield to Maturity 7 ... 1 Answer to Bond Price, Rate of Return, Yield to Maturity 7 Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year The bond has three year until maturity (a) Find the bond’s price today and six months from now after the next coupon is paid... Answered: Consider a bond paying a coupon rate of… | bartleby Solution for Consider a bond paying a coupon rate of 10% per year semi-annually when the market interest rate is only 4% per half-year. The bond has three years…

Consider a bond paying a coupon rate of 10 per year semiannually when the market. Solved - Consider a bond paying a coupon rate Answer ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b. What is the total rate of return on the bond? General Investment Definitions Investments-HW8-solutions.pdf - Solution for Assignment 8 ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. b. What is the total (6-month) rate of return on the bond? Solution: a. The bond pays $50 every 6 months. OneClass: Problem 10-16 Consider a bond paying a coupon ... Problem 10-16. Consider a bond paying a coupon rate of 8.50% per year semiannually when the market interest rate is only 3.4% per half-year. The bond has four years until maturity. a. Find the bond's price today and eight months from now after the next coupon is paid. (Do not round intermediate calculations. Chapter 10 Connect Flashcards - Quizlet Find the bond's price today and six months from now after the next coupon is paid. Current price: $1,068.72. Price after six months: $1,061.29. Consider a bond paying a coupon rate of 10.25% per year semiannually when the market interest rate is only 4.1% per half-year.

Ch14 Q14 Consider a Kubota bond paying a coupon rate of 10 ... Ch14 Q14 Consider a Kubota bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. b. What is the total ( 6-month) rate of return on the bond? Finance Chapter 1-5, 7-10 Flashcards - Quizlet An 8-year Treasury bond has a 10% coupon, and a 10-year Treasury bond has an 8% coupon. Both bonds have the same yield to maturity. ... The bonds have a 4.0% coupon rate, payable semiannually, and a par value of $1,000. They mature exactly 10 years from today. ... By how much do the firm's market and book values per share differ? $27.50. [Solved] Consider a bond paying a coupon rate of 10% per ... Consider a bond paying a couponrate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next couponis paid. b. What is the total (6-month) rate of return on the bond? Students also viewed these Accounting questions Consider a bond paying a coupon rate of 10% per year ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. (LO 10 a. Find the bond's price today and six months from now after the next coupon is paid b. What is the total rate of return on the bond?

FIN Module 3 Review.docx - Consider two bond issues, Issue ... O'Brien Ltd.'s outstanding bonds have a $1,000 par value, and they mature in 25 years. Their nominal yield to maturity is 9.25%, they pay interest semiannually, and they sell at a price of $850. What is the bond's nominal (annual) coupon interest rate? 7.70% Assume that a 15-year, $1,000 face value bond pays interest of $37.50 every 3 months. If an investor requires a simple annual rate of ... Consider a bond paying a coupon rate of 9.00% per year ... Consider a bond paying a coupon rate of 9.00% per year semiannually when the market interest rate is only 3.6% per half-year. The bond has six years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. CHAPTER 3 N = 40 (or 4 quarters per year times 10 years) IY = 13 (or the required market yield to maturity of the bond) PMT = $25 (or coupon interest rate of 10% times par value of $1000 = $100 per year and $25 per quarter since interest is paid quarterly) FV = $1000 (principal or par to be received by the bondholder at maturity) Solved: Consider a bond paying a coupon rate of 10% per ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. f'indthe bond's price today and•six months from now after the next coupon is paid. b. What is the total rate of return on the bond? Step-by-step solution

1. Consider a bond paying a coupon rate of 10% per year ... Answer of 1. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years... Questions & Answers Accounting Financial Accounting Cost Management Managerial Accounting Advanced Accounting Auditing Accounting - Others Accounting Concepts and Principles Taxation

Post a Comment for "42 consider a bond paying a coupon rate of 10 per year semiannually when the market"