39 are zero coupon bonds taxable

Taxable Bond Definition - Investopedia Taxable Bond: A debt security whose return to the investor is subject to taxes at the local, state or federal level, or some combination thereof. Collateralized mortgage obligation - Wikipedia The "principal-only" bonds would sell at a discount, and would thus be zero coupon bonds (e.g., bonds that you buy for $800 each and which mature at $1,000, without paying any cash interest). These bonds would satisfy investors who are worried that mortgage prepayments would force them to re-invest their money at the exact moment interest rates ...

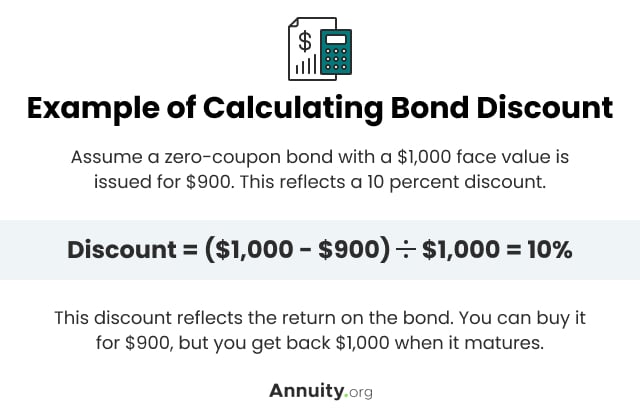

What Is a Zero-Coupon Bond? | The Motley Fool Zero-coupon bonds make money by being sold to investors at substantial discounts to face value. Zero-coupon bonds compensate for not paying any interest over the life of the bond by being ...

Are zero coupon bonds taxable

Tax Treatment of Bonds and How It Differs From Stocks - The Balance Zero-coupon bonds have specific tax implications. These securities are sold at a deep discount and pay no annual interest. The full face value is paid at maturity, but there's a catch. The IRS computes the "implied" annual interest on the bond, and you're liable for that amount even though you don't receive it until the bond matures. Interest on Us Treasury Bonds Is Not Taxable - Fernando A. Pena Jr. Zero coupon bonds are a special case. You may have to pay tax on their interest income, even if you don`t receive interest. Interest earned on a treasury bill is taxable as a capital gains in the year in which the invoice becomes due. It must be reported on your federal income tax return, Form 1040, and is taxed at the investor`s marginal tax rate. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia 31/01/2022 · Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ...

Are zero coupon bonds taxable. Zero-Coupon Bond Definition - Investopedia Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Understanding Bonds: The Types & Risks of Bond Investments Because bonds tend not to move in tandem with stock investments, they help provide diversification in an investor's portfolio. They also provide investors with a steady income stream, usually at a higher rate than money market investments Footnote 1. Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and … Government Bonds: Types, Benefits & How to Buy Government Bonds Interest earnings from GOI savings bonds are taxable according to the Income Tax Act 1961 under the purview of the investor s income tax slab. 7.75% GOI Savings Bonds are issued at a minimum of Rs. 1000 and in multiples of Rs. 1000 thereof. ... Zero Coupon Bonds earns zero interest i.e., no interest. The income generated from Zero-coupon bonds ... Zero Coupon Bonds: Know tax rules when such a bond is held till ... As the coupon rate of a zero coupon bond is zero per cent, people investing in such bonds don't get regular interest, but get a deep discount on face value at the time of issuance of such a bond.

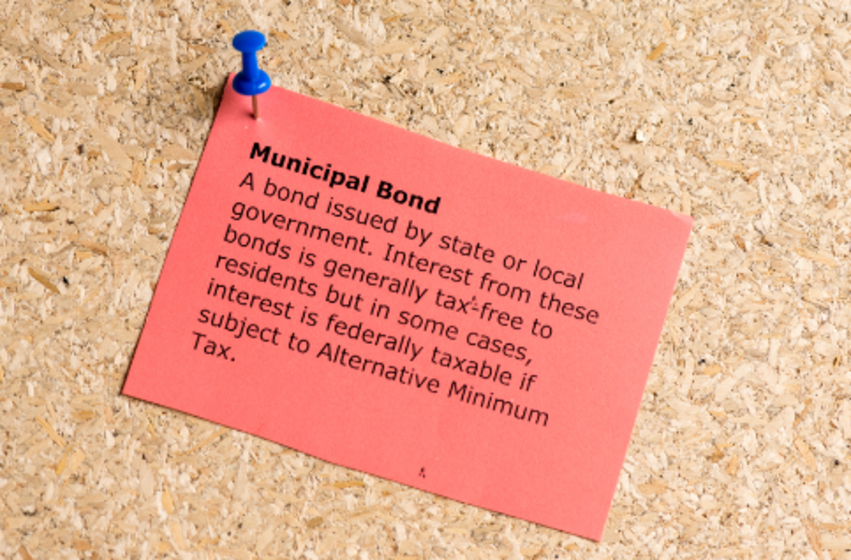

How Are Municipal Bonds Taxed? - Investopedia 17/01/2022 · Zero-coupon municipal bonds, which are bought at a discount because they do not make any interest or coupon payments, don’t have to be taxed. In fact, most aren't. › articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ... Zero coupon bonds: know the tax rules when such a bond is held to ... Related posts 7 Amazing 'Strong Buy' Stocks That Offer Safety and Big Dividends for Passive Income - 24/7 Wall St. 22.09.2022 Bitcoin, Ethereum, Crypto News, and Price Data - CoinDesk 22.09.2022 In terms of bonds, the coupon rate refers to the interest rate offered on a bond. Since the coupon rate of a zero-coupon bond […] How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Some investors also avoid paying taxes on imputed interest by buying zero-coupon municipal bonds. They are usually tax-exempt if the investor lives in the state where the bond was issued.

› ask › answersHow Are Municipal Bonds Taxed? - Investopedia Jan 17, 2022 · Zero-coupon municipal bonds, which are bought at a discount because they do not make any interest or coupon payments, don’t have to be taxed. In fact, most aren't. Zero Coupon 2025 Fund | American Century Investments 2013 Tax Form 8937 ... Invests in zero-coupon bonds, providing a dependable rate of return if held to maturity. Performance. Data reflects past performance for Investor Class shares, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom Zero coupon bonds that are notified and issued by REC and NABARD are taxable. Earnings from zero coupon bonds are also subject to capital gains tax at the time of maturity. The earnings or capital appreciation for zero coupon bonds is the difference between the maturity value and purchase price of the bond. Zero Coupon Bonds: Know tax rules when such a bond is held till ... The tax rules change, depending on the holding period, amount of gains or loss. In bond terms, coupon rate means the rate of interest offered on a bond. As the coupon rate of a zero coupon bond is ...

› corporate-bondsCorporate Bonds: Meaning, Features and Benefits - BondsIndia Bonds having a credit rating of AAA to BBB are considered as Investment Grade Bond, others are considered as Non-investment Grade Bond. Coupon rate: Corporate bonds have higher coupon rates than G-secs. Normally, corporate bonds provide 7% (AAA rated) to 12% (A rated) coupons in the current year 2021.

› logonLogin - David Lerner Associates Municipal Bonds: Credit Analysis; Taxable Municipal Bonds; Spirit of America Mutual Funds; Energy Resources 12; ... Zero Coupon Bonds. Assessing Risk; Learn about ...

› article › understanding-bondsUnderstanding Bonds: The Types & Risks of Bond Investments Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and the investor then receives the full face value of the bond at maturity. All bonds carry some degree of "credit risk," or the risk that the bond issuer may default on one or more payments before the bond reaches maturity.

What is the tax implication on zero coupon bonds? Updated. Any long term capital gain on sale of zero coupon bonds shall be charged to tax at minimum of the following: 20% of LTCG After indexation of cost of such bonds or 10% of LTCG before indexation of cost of such bonds. Zero coupon bonds, Investing in Zero Coupon Bonds, Tax Considerations for Zero Coupon Bonds Explained the tax implication ...

Are Bonds Taxable? 2022 Rates, Types of Bonds, Tax-Minimizing Tips Note: Muni bonds exempt from federal, state, and local taxes are known as "triple tax exempt." Zero-coupon bonds. Zero-coupon bonds are a special case. You might have to pay tax on their interest ...

How are Bonds Taxed Under the Income Tax Act? - Wint Wealth There are different types of bonds in the market. Let us look at their types and taxation. 1. Zero-Coupon Bonds. Zero-coupon bondholders are liable to only capital gain tax as they do not provide any interest income. However, these are issued at a discount. Hence, the difference is taxed as capital gain. 2.

& Walsh | Tax Free Municipal Bonds | Portfolio Management HEADQUARTERS: Hennion & Walsh, Inc. 2001 Route 46 Waterview Plaza Parsippany, NJ 07054

EOF

› government-bondsGovernment Bonds: Types, Benefits & How to Buy ... - BondsIndia Zero Coupon Bonds As the name suggests, Zero Coupon Bonds earns zero interest i.e., no interest. The income generated from Zero-coupon bonds accrues from the difference in the issuance price at a discount and redemption value at par. These bonds are created from existing securities rather than issuing them through auction.

Corporate Bonds: Meaning, Features and Benefits - BondsIndia Bonds having a credit rating of AAA to BBB are considered as Investment Grade Bond, others are considered as Non-investment Grade Bond. Coupon rate: Corporate bonds have higher coupon rates than G-secs. Normally, corporate bonds provide 7% (AAA rated) to 12% (A rated) coupons in the current year 2021.

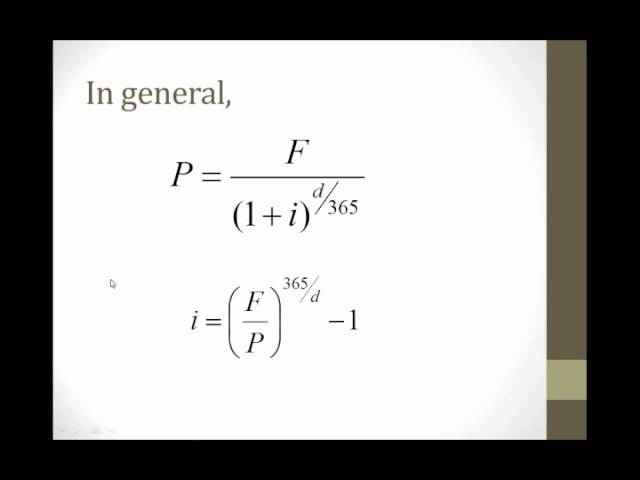

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ...

What Is a Zero-Coupon Bond? Definition, Characteristics & Example For instance, if a zero-coupon bond was sold at a $100 discount and matures in four years, its holder would have to pay the applicable bond interest tax rate on $25 worth of the bond's total $100 ...

Login - David Lerner Associates Municipal Bonds: Credit Analysis; Taxable Municipal Bonds; Spirit of America Mutual Funds; Energy Resources 12; Energy 11; Insurance + The ... Build America Bonds; Stripped Municipal Bonds + Zero Coupon Bonds. Assessing Risk; Learn about Mutual Funds; Learn about REITs + Learn about Retirement Planning. The Accumulation Years; The Pre ...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia 31/01/2022 · Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ...

Interest on Us Treasury Bonds Is Not Taxable - Fernando A. Pena Jr. Zero coupon bonds are a special case. You may have to pay tax on their interest income, even if you don`t receive interest. Interest earned on a treasury bill is taxable as a capital gains in the year in which the invoice becomes due. It must be reported on your federal income tax return, Form 1040, and is taxed at the investor`s marginal tax rate.

Tax Treatment of Bonds and How It Differs From Stocks - The Balance Zero-coupon bonds have specific tax implications. These securities are sold at a deep discount and pay no annual interest. The full face value is paid at maturity, but there's a catch. The IRS computes the "implied" annual interest on the bond, and you're liable for that amount even though you don't receive it until the bond matures.

Post a Comment for "39 are zero coupon bonds taxable"