39 us treasury bonds coupon rate

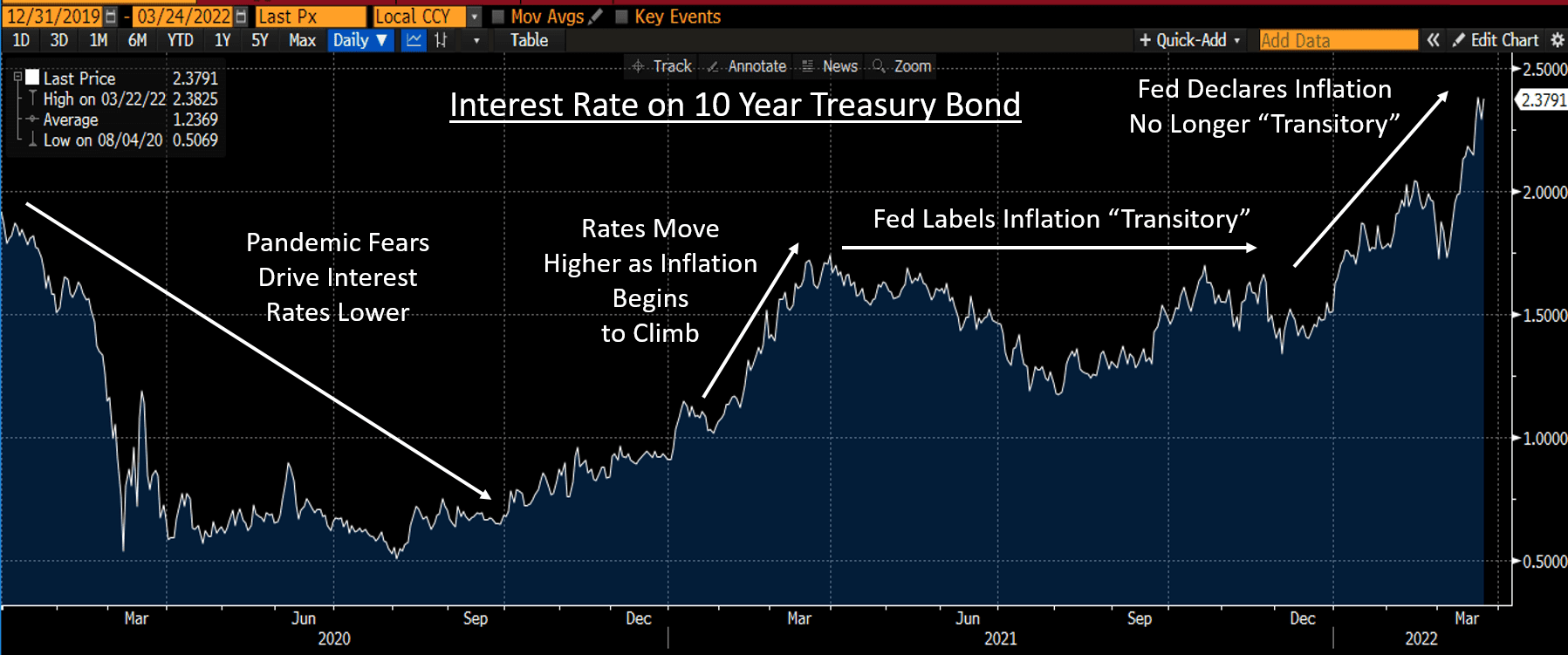

Stock Market Data – US Markets, World Markets, After Hours … Stock market data coverage from CNN. View US markets, world markets, after hours trading, quotes, and other important stock market activity. Understanding Bond Prices and Yields - Investopedia 28.06.2007 · Looking at the Treasury bonds with maturities of two years or greater, you'll notice the price is relatively similar around $100. For bonds, $100 is often used as the benchmark par value. That is ...

How to Buy US Treasury Bonds (Ameritrade, Fidelity, and more) 22.12.2021 · Unlike stocks, there isn’t a huge difference in price with bonds. Par is $100, the face value that US Treasury Bonds sell for. If the coupon rate is higher than the interest rate, they will add a premium. So, if a coupon price is paying 5.25% and the interest on the bond is only 1.4%, you’ll pay more per bond than $100.

Us treasury bonds coupon rate

Treasuries - WSJ Market Data Center. News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data Front page | U.S. Department of the Treasury Treasury Interest Rate Statistics . On a daily basis, Treasury publishes Treasury Par Yield Curve Rates, Treasury Par Real Yield Curve Rates, Treasury Bill Rates, Treasury Long-Term Rates and Extrapolation Factors, and Treasury Real Long-Term Rate Averages.

Us treasury bonds coupon rate. Treasury Bonds vs. Treasury Notes vs. Treasury Bills: What's the ... 29.03.2022 · Note Auction: A formal bidding process that is scheduled on a regular basis by the U.S. Treasury. Currently there are 17 authorized securities dealers (primary dealers) that are obligated to bid ... How to Buy Treasury Bonds: 9 Steps (with Pictures) - wikiHow 06.05.2021 · In addition to par value, bonds are sold at a given "interest rate," which is the percentage of the bond par value the bond will pay in interest every six months. Treasury bonds pay the holder each six months. Here is an example of a treasury bond with a par value of $100 and an interest rate of 5 percent. Before the auction, bidders already ... US Treasury Bonds - Fidelity US Treasury bonds: $1,000: Coupon: 20-year 30-year: Interest paid semi-annually, principal at maturity: Treasury inflation-protected securities (TIPS) $1,000: Coupon: 5-, 10-, and 30-year : Interest paid semi-annually, principal redeemed at the greater of their inflation-adjusted principal amount or the original principal amount: US Treasury floating rate notes (FRNs) $1,000: … What Are Treasury Bills (T-Bills) and How Do They Work? 02.06.2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

Front page | U.S. Department of the Treasury Treasury Interest Rate Statistics . On a daily basis, Treasury publishes Treasury Par Yield Curve Rates, Treasury Par Real Yield Curve Rates, Treasury Bill Rates, Treasury Long-Term Rates and Extrapolation Factors, and Treasury Real Long-Term Rate Averages. Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data Treasuries - WSJ Market Data Center. News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services.

Post a Comment for "39 us treasury bonds coupon rate"