42 advantage of zero coupon bond

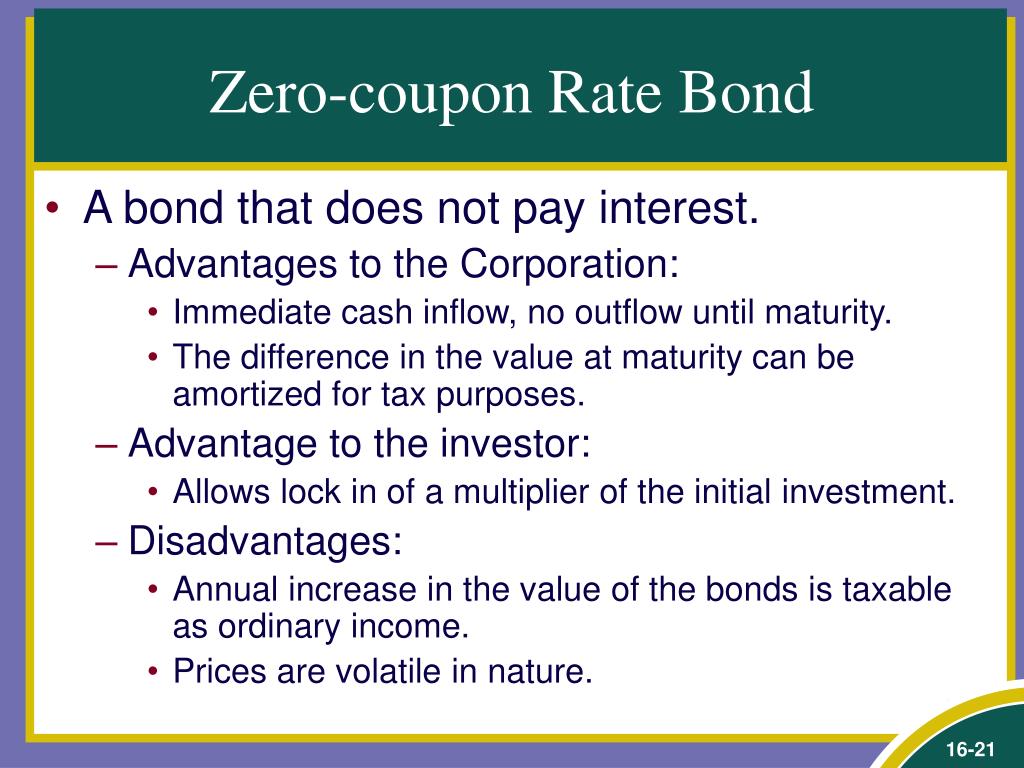

Invest in Zero Coupon Bond at Yubi | Learn All About It The imputed interest added to the purchase price gives yield to maturity of the zero coupon bond, which the investor receives automatically in the future as a phantom income. The long time horizon of zero coupon bonds is a major advantage for investors. With long-term maturity dates, bond buyers do not need to worry about the short term. What Is a Zero-Coupon Bond? Definition, Advantages, Risks Advantages of zero-coupon bonds They often have higher interest rates than other bonds Since zero-coupon bonds do not provide regular interest payments, their issuers must find a...

What Is a Zero-Coupon Bond? - Investopedia Because they offer the entire payment at maturity, zero-coupon bonds tend to fluctuate in price, much more so than coupon bonds. 1 A bond is a portal through which a corporate or...

Advantage of zero coupon bond

Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia Advantages of Zero-Coupon Bonds Meet Long-term Goals Zero-Coupon Bonds don't offer regular interest. Instead, the earned interest is accumulated and paid at the maturity. It thus helps create funds that can help meet your long-term goals. Fixed Returns What are the advantages and disadvantages of zero-coupon bond? Feb 4, 2017 ... A zero coupon bond is a bond that pays off at maturity, but makes no payments until maturity. It is sold at a discount. They are much more sensitive to yield ... Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 - TaxWink The term "Zero Coupon Bond" has been defined by Section-2(48) of the Income Tax Act as below: - ... Further, the most important advantage of the zero coupon bonds is that no tax is payable on interest element if you invest in notified zero coupon bonds. These are subject to capital gains tax only.

Advantage of zero coupon bond. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Here are the key differences between Zero-coupon Bond and Regular Coupon Bearing Bond Advantages #1 - Predictability of Returns What Is The Advantage Of Investing In A Zero Coupon Bond - Atish Lolienkar Advantage of zero coupon bond Guaranteed return Zero coupon bonds are issued for a rate much lower than the actual face value of the bond. Thus, it is evident that the investor will get the face value once maturity. The final price and the time when the investor will receive is defined, making it a guaranteed source of return on maturity. The Pros and Cons of Zero-Coupon Bonds - Financial Web One of the big advantages of zero coupon bonds is that they have higher interest rates than other corporate bonds. In order to attract investors to this ... The Pros and Cons of Zero-Coupon Bonds - m.finweb.com Here are some of the pros and cons of investing in zero-coupon bonds. Pros One of the big advantages of zero coupon bonds is that they have higher interest rates than other corporate bonds. In order to attract investors to this type of long-term proposition, companies have to be willing to pay higher interest rates.

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Some of the advantages of these bonds have been mentioned below: Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over longer periods of time, the perceived risk is more. What Is a Zero-Coupon Bond? Definition, Advantages, Risks Jul 28, 2022 ... The biggest draw of zero-coupon bonds is their reliability. If you keep the bond to maturity, you will essentially be guaranteed a sizable ... The best advantage of a zero-coupon bond to the issuer is that the ... The best advantage of a zero-coupon bond to the issuer is that the. Bond requires a low issuance cost. Bond requires no interest income calculation to the holder or issuer until maturity. Interest can be amortized annually by the APR method and need not be shown as an interest expense to the issuer. Interest can be amortized annually on a ... Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom This is because zero coupon bonds can help in securing a guaranteed return at the end of a fixed time period. Since these bonds offer discounts for longer investment tenures, they are ideal for those who have long-term investment plans. What are the benefits of investing in Zero-Coupon Bond?

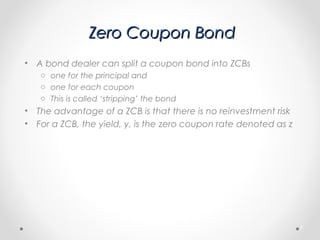

What is Zero Coupon Bond? - Groww It is important to understand the advantages of a Zero Coupon bond before opting for this investment. The advantages are mentioned below: No reinvestment risk: Other coupon bonds don't allow investors to a bond's cash flow at the same rate as the investment's required rate of returns. But the Zero Coupon bonds remove the reinvestment risk. What Are Zero Coupon Bonds And Their Risks- Tavaga | Tavagapedia What are the advantages of a Zero-Coupon Bond? ... Zero-Coupon Bonds prove to be a safer option as compared to other fixed income instruments. They render good ... Coupon Bond Vs. Zero Coupon Bond: What's the Difference? - Investopedia Zero-coupon bonds are more volatile than coupon bonds, so speculators can use them to profit more from anticipated short-term price movements. Zero-coupon bonds can help investors to... Zero-Coupon Bond - Definition, How It Works, Formula Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year.

Zero-Coupon Bonds | AnnuityAdvantage For example, a zero-coupon bond with a face value of $5,000, a maturity date of 20 years, and a 5% interest rate might cost only a few hundred dollars. When the bond matures, the bondholder receives the face value of the bond ($5,000 in this case), barring default. The value of zero-coupon bonds is subject to market fluctuations.

What is a Zero-Coupon Bond? Definition, Features, Advantages ... Advantages of Zero-Coupon Bond A zero-coupon bond is a secured form of investment when done for the long term. The various benefits it can provide are mentioned below: Predictable Returns: The return on a deeply discounted bond after maturity, is pre-known to the investor in the form of par value or face value.

zero coupon bond - Definition, Understanding, and Why ... - ClearTax Oct 18, 2022 ... Advantages Of Zero-Coupon Bond ... No reinvestment risk: Other coupon bonds don't let investors to a bond's cash flow at the same rate as the ...

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... From an investor's perspective, zero coupon bonds have the following advantages: They are safe investment instruments and have a lower element of risk involved. Long Dated zero coupon bonds are the most responsive to interest rate fluctuations. Therefore, it might be profitable for the bondholder in the case of a long duration (a higher 'N').

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Advantages of Zero-Coupon U.S. Treasury Bonds Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right...

What are the advantages and disadvantages of zero-coupon bond? What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival.

Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 - TaxWink The term "Zero Coupon Bond" has been defined by Section-2(48) of the Income Tax Act as below: - ... Further, the most important advantage of the zero coupon bonds is that no tax is payable on interest element if you invest in notified zero coupon bonds. These are subject to capital gains tax only.

What are the advantages and disadvantages of zero-coupon bond? Feb 4, 2017 ... A zero coupon bond is a bond that pays off at maturity, but makes no payments until maturity. It is sold at a discount. They are much more sensitive to yield ...

Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia Advantages of Zero-Coupon Bonds Meet Long-term Goals Zero-Coupon Bonds don't offer regular interest. Instead, the earned interest is accumulated and paid at the maturity. It thus helps create funds that can help meet your long-term goals. Fixed Returns

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "42 advantage of zero coupon bond"