45 coupon rate on bonds

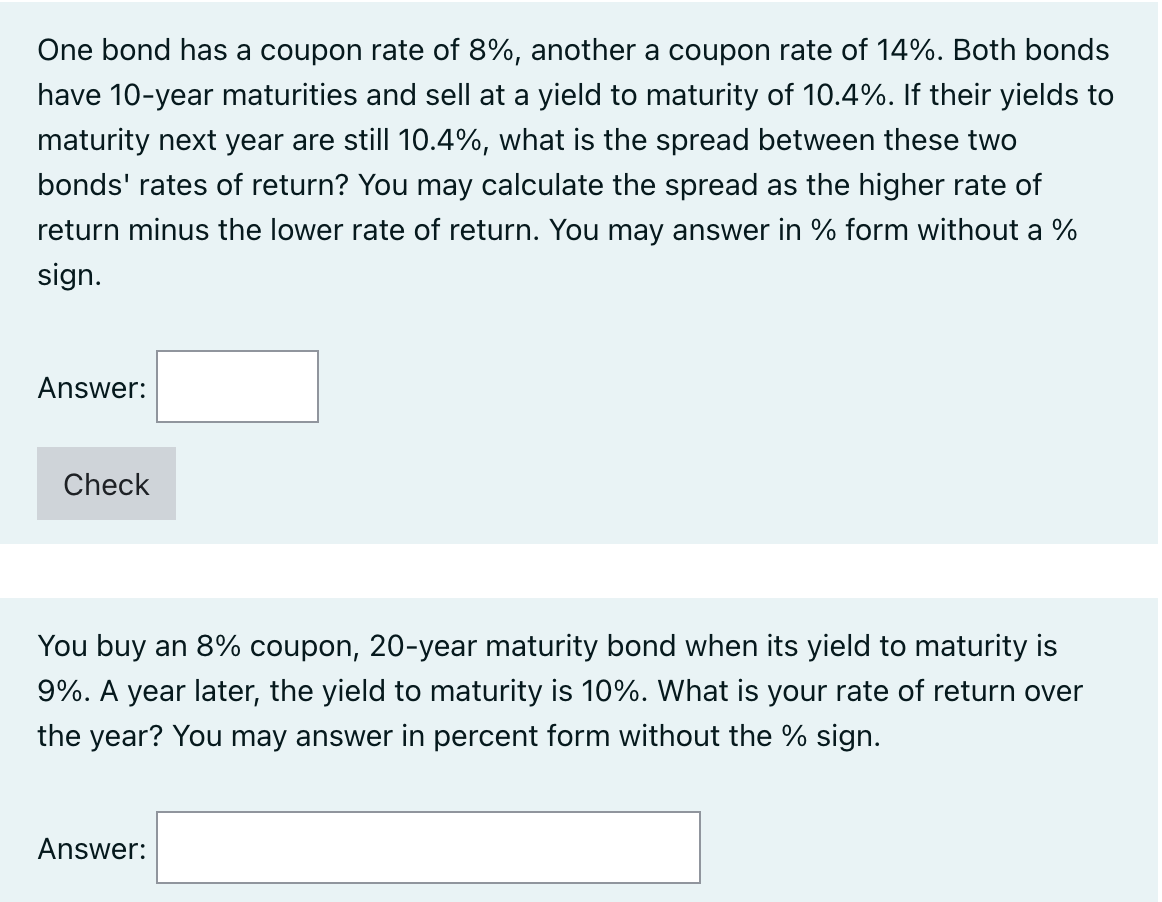

Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

BONDS | BOND MARKET | PRICES | RATES | Markets Insider The nominal value is the price at which the bond is to be repaid. The coupon shows the interest that the respective bond yields. ... The credit terms for bonds, such as the rate of return, term ...

Coupon rate on bonds

MSRB: Bond Prices and Yields - Municipal Securities Rulemaking Board Your coupon payments are equal to the bond's par value times the coupon rate divided by the frequency of the coupons. Thus, a $10,000 fixed-rate bond paying interest at 5 percent would pay $500 in interest each year, usually payable in equal $250 semi-annual payments ($500/$10,000 = 5 percent). This amount does not change, regardless of the ... Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's... Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

Coupon rate on bonds. Coupon Rate Structure of Bonds — Valuation Academy 1) Fixed Rate Bonds have a constant coupon rate throughout the life of the bond. For example: a Treasury bond with face amount (or principal amount) $1000 that has a 4% coupon and matures 6 years from now, the U.S. Treasury has to pay 4% of the par value ($40) each year for 6 years and the par value ($1000) at the end of 6 years. Coupon Bond | Definition | Rates | Benefits & Risks | How It Works A coupon bond is an investment that pays a regular interest payment to the holder of the security. The issuer guarantees that it will pay this amount as long as they hold on to the coupon bond. The issuer is also obligated to repay the whole of the bond's face value on its maturity date. Coupon bonds are typically paid twice per year by ... What Is a Coupon Rate? And How Does It Affects the Price of a Bond ... To calculate the bond coupon rate, total annual payments need to be divided by the bond's par value. Annual payments = $ 50 Coupon rate = $500 / $1,000 = 0.05 The bond's coupon rate is 5 percent. This is the portion of bond that shall be paid every year. How the Coupon Rate Affects the Price of a Bond? Coupon Rate: Formula and Bond Yield Calculator - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM). Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Coupon Rate Formula | Step by Step Calculation (with Examples) Do the Calculation of the coupon rate of the bond. Annual Coupon Payment Annual coupon payment = 2 * Half-yearly coupon payment = 2 * $25 = $50 Therefore, the calculation of the coupon rate of the bond is as follows - Coupon Rate of the Bond will be - Example #2 Let us take another example of bond security with unequal periodic coupon payments. Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment. Coupon Types - Financial Edge The coupon formula is 3-Month Libor + 1.2% (i.e. 2.68% + 1.2% = 3.88%). The coupon rate (3.88%) is given by the coupon formula - with quarterly interest payments. Assume that LIBOR has been fixed at 2.68%. The next coupon payment, assuming that LIBOR has been fixed at the aforesaid rate, is computed below (US$970,000). How To Find Coupon Rate Of A Bond On Financial Calculator How to Calculate Coupon Rate of a Bond On A Financial Calculator: The coupon rate is the interest that a bond pays per year, divided by the bond's face value. For example, if a bond has a face value of $1,000 and pays a coupon rate of 5%, then the bond will pay $50 in interest each year. Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

What is a Coupon Rate? | Bond Investing | Investment U Calculating a bond's coupon rate comes down to examining its par value and its yield. Specifically, investors would divide the sum of annual interest payments by the par value: Coupon Rate = Total Coupon Payments / Par Value For example, if a company issues a $1,000 bond with two $25 semi-annual payments, its coupon rate would be $50/$1000 = 5%.

Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .)

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same.

Coupon Rate Calculator | Solution Step by Step 🥇 The coupon rate is the yield that a bond pays annually. The coupon rate is calculated as the sum of all periodic interest payments made on a bond divided by the face value of that bond. The coupon rate will typically be lower than the stated interest rate, which is also referred to as a nominal interest rate or nominal yield. ...

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value ...

What is 'Coupon Rate' - The Economic Times The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 per cent, you will get Rs 200 every year for 10 years, no matter what happens to the bond price in the market.

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's...

MSRB: Bond Prices and Yields - Municipal Securities Rulemaking Board Your coupon payments are equal to the bond's par value times the coupon rate divided by the frequency of the coupons. Thus, a $10,000 fixed-rate bond paying interest at 5 percent would pay $500 in interest each year, usually payable in equal $250 semi-annual payments ($500/$10,000 = 5 percent). This amount does not change, regardless of the ...

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "45 coupon rate on bonds"